Category: Tips & tools

Need to explain the basics about financing? Want tips on creating competitive listings? We cover real estate tips from A to Z.

-

A Builder’s Letter to Real Estate Agents

Read more: A Builder’s Letter to Real Estate AgentsWhen a customer walks into one of our sales centers with a real estate agent, it makes our heart happy! Not only do we know that the homebuyer will generally be more informed, but we’re confident that the agent will help the process go more smoothly for everyone. Since Valentine’s Day is approaching, we thought…

-

Online Resources for Real Estate Agents

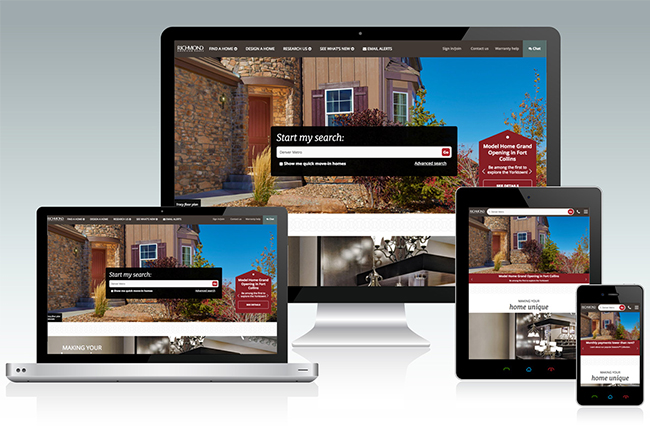

Read more: Online Resources for Real Estate AgentsHave you seen our brand-new website design? The new-and-improved RichmondAmerican.com is just one of a range of online resources we’ve developed that real estate agents can use to succeed in new home sales. A new site and a new Agent Hub! It’s easy to spot all the ways we’ve enhanced our site’s usability for homebuyers,…

-

2018 VA Home Loan Limits

Read more: 2018 VA Home Loan LimitsDid you know that 2018 VA loan limits for 100% financing will increase across thousands of counties? For military buyers, that could mean their borrowing power will get a boost—potentially by thousands of dollars! Learn more about this popular loan option on the U.S. Department of Veterans Affairs’ website, then check out the new limits…

-

5 Articles to Fortify Your Fall Marketing

Read more: 5 Articles to Fortify Your Fall MarketingAs fall sales head toward the winter slump, you may find yourself looking for ways to make a few more sales and stay on your lead list’s radar through the holidays. One great method is to share helpful real estate stories through your email program, on your blog or via social media. Below are just…

-

How to Help a “Boomerang Buyer”

Read more: How to Help a “Boomerang Buyer”It’s 2017, and that means many Americans who were hardest hit by the Great Recession have had time to reestablish their credit and may be thinking about owning a home again. These boomerang buyers—former homeowners looking to reenter the market after having been sidelined by foreclosure or bankruptcy—can be a great demographic for expanding your…

-

Home Tour Tip: Entertain the Kids!

Read more: Home Tour Tip: Entertain the Kids!If your clients ever have trouble entertaining young children during a model home tour, here’s your chance to be their hero! Bring along a few home-themed coloring sheets and crayons or colored pencils and ask them how they would decorate their dream home. The prospect of moving may seem intimidating for little ones, so this is…

-

Sellers Stressing You Out? Try Selling New Homes!

Read more: Sellers Stressing You Out? Try Selling New Homes!A home is one of the largest financial and emotional investments many people will make in their lifetime. Is it any wonder that when it’s time to move on, a home seller might have difficulty viewing things objectively? Here are a couple of common situations that could be avoided by selling new homes instead! Highly…

-

6 Real Estate Articles to Share this Summer

Read more: 6 Real Estate Articles to Share this SummerLooking for articles to share with your clients (and potential clients)? Don’t forget about our homebuyer blog, Homeward™! It’s full of stories for house hunters, home sellers and homeowners alike. Feel free to link them from your social media accounts, blog or emails as a way of keeping in touch with past customers, educating current…

-

10 Reasons Buyers Love New Homes

Read more: 10 Reasons Buyers Love New HomesWhether you’re new to selling new homes, or just need a refresher, here’s a handy infographic to help you communicate the value of new construction to your clients. For more in-depth information, tips and tools, be sure to download our free Selling New Homes Guide, created just for agents like you!

-

Student Loan Debt and Homeownership

Read more: Student Loan Debt and HomeownershipHaving a college education is very valuable. Unfortunately, the price tag often reflects this, and navigating post-graduation financial waters can be tricky. That being said, student loan debt shouldn’t be a barrier to homeownership. There are ways to balance the responsibility of paying off student loans and still enjoy homeownership. Here are a few concerns…